CBM(Covered Business Method)是AIA美國改革法案中對於商業模式專利的一種異議制度(PGR),特別是商業、軟體方法是否符合美國專利法第101條為法定可專利標的的異議程序。

CBM相關部落格文章:

AIA後異議程序整理(美國):

http://enpan.blogspot.tw/2014/03/blog-post_26.html

http://enpan.blogspot.tw/2012/09/blog-post_18.html

http://enpan.blogspot.tw/2014/02/cbmcrs-v-frontline.html(CBM案例)

http://enpan.blogspot.tw/2012/09/ptab101.html(PTAB會考慮專利是否符合101)

以下就案例CBM2012-00001提出報告。

本案例在2012/09/16施行新法異議制度當天就提出申請:

系爭專利:US6,553,350(350專利)

是一種多層次的定價專利(Method and apparatus for pricing products in multi-level product and organizational groups),看來就是商業方法,因此面對CBM就是101的議題。

所揭露的系統管理多種的價格表,包括各種物品的資訊、買賣資訊與價格調整資訊,經取得物品在各個階段的價格後,作出最後定價,本次提出Post-Grant Review(針對商業方法適格101法條的異議程序則稱為CBM)的權利範圍為Claims 17, 26-29。

列舉其中Claim 17,其中判斷物品價格的方法包括安排販售組織的層次結構、物品的層次結構、儲存價格資訊,包括定價樣態、組織與物品等資訊,接著取得可用的定價資訊、儲存後估計價格與判斷物品定價。

17. A method for determining a price of a product offered to a purchasing organization comprising:

arranging a hierarchy of organizational

groups comprising a plurality of branches such that an organizational

group below a higher organizational group in each of the branches is a

subset of the higher organizational group;

arranging a hierarchy of product groups

comprising a plurality of branches such that a product group below a

higher product group in each of the branches in a subset of the higher

product group;

storing pricing information in a data

source, wherein the pricing information is associated, with

(i) a

pricing type,

(ii) the organizational groups, and

(iii) the product

groups;

retrieving applicable pricing information

corresponding to the product, the purchasing organization, each product

group above the product group in each branch of the hierarchy of product

groups in which the product is a member, and each organizational group

above the purchasing organization in each branch of the hierarchy of

organizational groups in which the purchasing organization is a member;

sorting the pricing information according

to the pricing types, the product, the purchasing organization, the

hierarchy of product groups, and the hierarchy of organizational groups;

eliminating any of the pricing information

that is less restrictive; and

determining the product price using the

sorted pricing information.

很不幸的,這類有關商業方法(美國專利分類705/20)的權利範圍通常會用很廣的範圍來考量。

CLASS 705

DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION

DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION

次分類20 Price look-up processing

組織層次:

物品層次:

註:

The AIA defines a covered business method (“CBM”) patent as “a patent that claims a method or corresponding apparatus for performing data processing or other operations used in the practice, administration, or management of a financial

product or service . . . .”

PGR(CBM)過程中,請願人認為系爭專利權利項所界定的商業方法中,即便有硬體的連結,但這些都是一般目的的電腦裝置,並無任何技術思想,沒有解決任何技術問題(這是我的詮釋),更有些權利範圍更沒有連結基本的電腦系統。請願人更聲明,即便可能解決了一些問題,但根據所提出的先前技術,這些並沒有任何技術貢獻,沒有改良任何技術,沒有新穎性。

請願人同時提出101, 112, 102的無效意見,包括專利非法定可專利的方法、權利範圍不明確以及新穎性不足等:

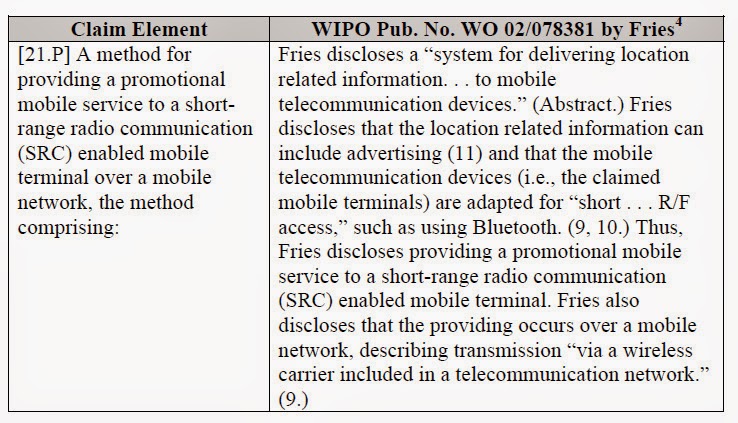

不免提出先前文獻與專利範圍的比對表:

PTAB於2013/6/11作出最終決定(final decision),PTAB同時考量了請願人認為應該用最廣解釋角度來解釋專利範圍,專利權人則希望應該用更限定的解釋方法,然而PTAB認為,如果專利權人希望用更限定的方式解釋專利範圍,應該用更多限制來描述專利範圍,也聲明其決定根據專利審查施行的規則:

法條參考:

Subpart D—Transitional Program for Covered Business Method Patents

§42.300 Procedure; pendency.

(a) A covered business method patent review is a trial subject to the procedures set forth in subpart A of this part and is also subject to the post-grant review procedures set forth in subpart C except for §§42.200, 42.201, 42.202, and 42.204.

(b) A claim in an unexpired patent shall be given its broadest reasonable construction in light of the specification of the patent in which it appears.

(c) A covered business method patent review proceeding shall be administered such that pendency before the Board after institution is normally no more than one year. The time can be extended by up to six months for good cause by the Chief Administrative Patent Judge.

(d) The rules in this subpart are applicable until September 15, 2020, except that the rules shall continue to apply to any petition for a covered business method patent review filed before the date of repeal.

PTAB也提出的claims比對,顯然認為其中的主要元件都是一般的資訊表達。

最後認為系爭專利Claims 17, 26-29不符美國專利法第101條法定可專利標的的規定:

PTAB引用Bilski, CLS bank等與101相關的案例,這樣子就大約知道PTAB的態度。

PTAB結論:

裁定Claims 17, 26-29不具專利性,應刪除:

稍後於2013/7/11要求覆審(request for rehearing)。

請願人於2013/7/18提出反對覆審。

PTAB於2013/9/13駁回覆審請求:

專利權人於2013/11/13提出上訴。

Ron